Digital Currency Promises New Opportunities For MSMEs

By: , November 2, 2021The Full Story

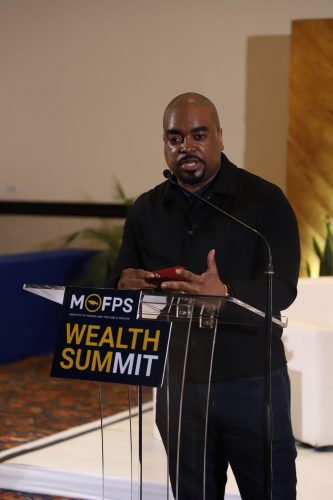

Local entrepreneurs are heralding the opportunities that now exist for Jamaicans due to digital transition. The stance was made at the recently concluded Wealth Summit on Digital Financial Inclusion hosted by the Ministry of Finance and the Public Service.

All six presenters at the summit, who were drawn from the public and private sectors, advocated for the benefits to be derived from the digital transitions taking place in Jamaican businesses. The presentations outlined how adapting to the digital shift can redound to the benefit of not just individuals but the country at large.

In making the case, Deputy Governor of the Bank of Jamaica, Natalie Haynes, spoke about the BOJ’s initiative on digital currency. Mrs. Haynes noted that through the Central Bank Digital Currency (CBDC) Project, the Bank will contribute to the financial inclusion process by enabling easy to obtain, simple and secure access to financial products and services. “Central bank digital currencies (CBDC) are a digital form of money issued by a central authority. CBDC serves as an addition to the current pool of retail payment instruments in Jamaica.” Mrs. Haynes said.

Noted financial guru and Chief Executive Officer of Supreme Ventures Services Limited, Dennis Chung, focused on the topic Transitioning to Digital. Mr. Chung said Supreme Ventures was able to successfully transition during the pandemic by being innovative: “There is a difference between digital transformation and digital transition. Digital transition is really about upgrading software but transformation is when we deploy dramatic new technology. What we have done is to blow up the old business models, and if we don’t do that it is going to be difficult to survive.”

Mr. Chung contended that digital transformation had to cater to the needs of the customers. “We already have mobile applications in place and we (Supreme Ventures) are probably the largest mobile company in terms of transactions in the region. What we did was to set it up that our back office operations is communicating effectively with our front office and our retail operations. It’s a whole transformation that needs to happen; so what we do is move from the base to the customer. That is how we have to be thinking if we are going to be transforming ourselves digitally and creating value for our customers and, ultimately, for the country from a productive point of view,” he said.

Chief Executive Office of Mobile Edge Solutions, Leighton Campbell, echoed the sentiments that digital inclusion is paramount to getting Jamaica out of poverty. In his 20-minute presentation Mr. Campbell reiterated how his company offered solutions for entrepreneurs to getting paid online.

“I strongly believe that getting online is one of the easiest ways to drive entrepreneurship. The more we enable it the more we educate persons on it, it is better for them. I believe this is an equaliser in the space [for] someone who is a small man; once they can market themselves online [they] can compete in the marketplace.” Mr. Campbell noted.

General Manager for Channels, Relationships & Marketing at the Development Bank of Jamaica, Edison Galbraith, explained how the DBJ was financing digitisation for micro, small and medium-sized enterprises. He maintained that the DBJ had the best opportunities for MSMEs through the DBJ Serve Jamaica Programme.

Chief Executive Officer of tTech, Chris Reckord, highlighted how persons can protect their online transactions.

A final discussion was held with Mrs. Haynes and CEO of TFOB (2021) Limited, a subsidiary of NCB Financial Group Limited, Vernon James, who indicated that the National Commercial Bank had developed Lynk to work in tandem with the digital currency programme of the BOJ. “Lynk will be the vehicle for consumers to receive, transport and utilise CBDC. Lynk will be a unique product for [the] Jamaican market because you can open an account digitally in five minutes, no paperwork needed.” Mr. James said.

Persons are advised to keep updated on the new developments that are taking place to enable digital financial inclusion in the island.