House Approves Terrorism Prevention Order

By: , February 2, 2022The Full Story

The House of Representatives, on Tuesday (February 1), approved the Terrorism Prevention (Designated Reporting Entity) (Trust and Corporate Services Providers) Order, 2022.

The designation aims to strengthen the country’s financial and non-financial systems, while making them more robust and transparent.

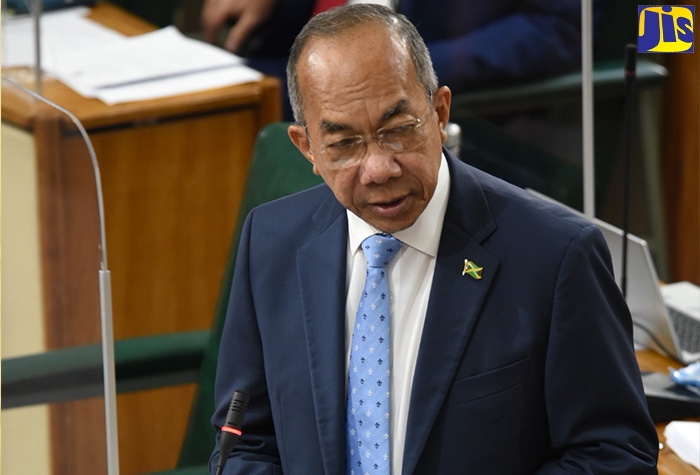

Minister of National Security, Hon. Dr. Horace Chang, said money laundering and the financing of terrorism are threats to the financial sector that must be addressed with a sense of urgency.

“Any loopholes within our financial system will provide opportunities for criminals to move their funds to, through or within jurisdictions that do not have the requisite safeguards. Strengthening our frameworks will, therefore, disrupt the access of criminals to resources and make it more difficult for them to profit from their illicit activities,” Dr. Chang said.

He noted that the Order forms part of Jamaica’s national action plan to enhance its Anti-Money Laundering/Counter Terrorism Financing framework.

Section 15 (2) of the Terrorism Prevention Act, permits the Minister of Foreign Affairs and Foreign Trade, by order subject to affirmative resolution, to designate an entity as a reporting entity for certain purposes under that Act.

Dr. Chang informed that Section 14 of the Terrorism Prevention Act provides that an entity will be classified as a ‘listed entity’ if it is designated as a terrorist entity by the United Nations Security Council, or if the Director of Public Prosecutions (DPP) has reasonable grounds to believe that the entity knowingly committed or participated in the commission of a terrorism offence, or is knowingly acting on behalf of, at the direction of, or in association with an entity so designated by the United Nations.

Additionally, he said an entity can only be designated as a “listed entity” pursuant to an order from a Judge of the Supreme Court based on an application of the DPP. To date, Jamaica’s Court Orders relate only to entities designated by the United Nations Security Council.

Also, Section 15 of the Terrorism Prevention Act provides that certain entities (“Reporting Entities”) must periodically report whether they are in possession or control of property owned or controlled by or on behalf of a “listed entity”.

“Reporting entities must also notify the Financial Investigations Division (FID) where they suspect that a transaction involves property that is connected with or is intended to be used in the commission of a terrorism offence or is involved with or for the benefit of a listed entity or a terrorist group,” Dr. Chang said.

“Businesses other than financial institutions and businesses in the financial sector may be designated as reporting entities under the Terrorism Prevention Act. This was done in 2017 in respect of sectors such as real estate dealers, casinos, gaming machine operators, and accountants,” he added.

The Minister noted that the Order and the Proceeds of Crime (Designated Non-Financial Institution) (Trust and Corporate Services Providers) Order, 2022 which was approved in the Lower House on January 11, 2022, will ensure the effective supervision of trust and corporate services providers operating in Jamaica.

Dr. Chang said that the effective supervision of trust and corporate services providers is one of the targets of Recommendation 40 of the Financial Action Task Force (FATF) Recommendations.

In FATF’s 2017 Mutual Evaluation Report, the monitoring of providers of trust and corporate services was identified as one of the areas requiring improvement in Jamaica’s National Risk Assessment.

“The implementation of the Terrorism Prevention (Designated Reporting Entity) (Trust and Corporate Services Providers) Order, 2022 and other critical anti-money-laundering and counter-terrorist-financing initiatives that are in train, will further strengthen Jamaica’s financial systems, disrupt the financing of illicit activities and, more generally, ensure compliance with applicable international standards,” Dr. Chang said.

He added that the Order is, therefore, another critical step in Jamaica’s anti-money-laundering efforts and is deserving of fulsome support.