Saturday Business for Select Tax Offices

By: , January 25, 2022The Full Story

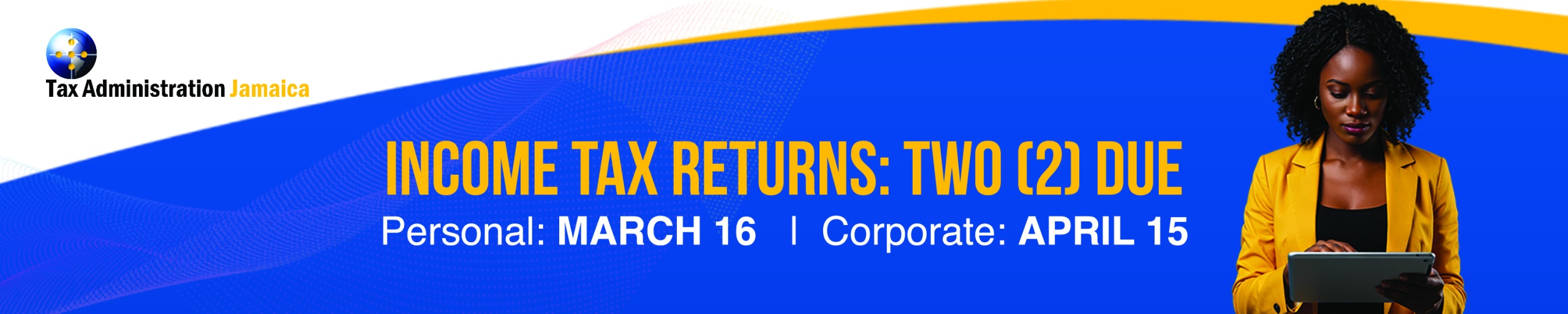

Tax Administration Jamaica (TAJ) is reminding the public that it will open select Tax Offices this Saturday January 29, 2022, and every last Saturday of the month for the remainder of the 2021/22 financial year, subject to any announcements by the government on Covid containment measures.

The following Tax Offices will operate this Saturday between the hours of 10:00 am – 2:00 pm:

• St. Andrew

• Montego Bay

• Mandeville

• Savanna-La-Mar

• St. Ann’s Bay

• Old Harbour

The Portmore Tax Office will continue its usual weekly Saturday operations, with adjusted business hours (9:00 am – 2:00 pm).

The Saturday service enhancement provides taxpayers with a convenient option of doing business on these weekends, as well as to alleviate the usually high walk-in traffic at Tax Offices during the busy month-end weekday period.

Taxpayers will be able to access taxpayer service activities including processing motor vehicle registration and other motor vehicle transactions, applying for a Taxpayer Registration Number (TRN), dropping off documents for the renewal of their Driver’s Licence, and make tax and fee payments, as the Tax Authority continues to provide additional access to its services.

Persons wishing to make payments for Property Tax may opt to utilise the added convenience of TAJ’s weekend operating hours. Additionally, motorists who have not as yet collected their printed Driver’s Licence cards, are able to do so at any of the listed locations, if their applications were dropped off there. Audit and compliance activities will not be available during the Saturday operations.

Persons are reminded, that they may opt to avoid a Tax Office visit entirely by conducting several transactions online, to include payment for Driver’s Licence renewal, Fitness Certificate, Traffic Ticket, business related taxes and deductions and Property Tax, as well as electronically querying Property Tax liabilities.

Customers may also avail themselves of a range of other online payments options, including making tax payments via National Commercial Bank, as NCB customers are able to use their online banking platform by adding TAJ as a Payee. Additionally customers are able to make several business payments via the new TAJ Direct Funds Transfer process. These are in addition to customers being able to make payments via the Tax Authority’s website www.jamaicatax.gov.jm using a credit card or other banking card with credit card features or using the Scotiabank’s automatic direct deposit via TAJ’s website.

Additionally, TAJ has further expanded its Direct Funds Transfer (DFT) payment channel by adding Stamp Duty and Transfer Tax as a payment type and including its Scotia Bank account as a beneficiary account. This means that in addition to the ability to make payments for Payroll Deductions, Income Tax, Consumption Taxes, Trade and Business Licences, as well as several other business-related taxes, customers now also have the ability to make Stamp Duty and Transfer Tax payments using the convenient DFT option.

The necessary COVID-19 protocols that have been implemented for the safety of its staff and clients, will also be observed during the month-end Saturday openings. Persons are therefore urged to cooperate with the instructions of security personnel at its locations, to form an orderly line, wear a mask, sanitize their hands and maintain the recommended physical distance of at least 6 feet.