Young People Learning Financial Literacy

By: , March 22, 2023The Full Story

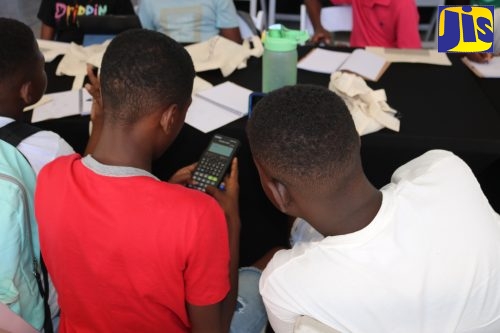

Approximately 240 students from three communities in the Corporate Area and St. Catherine are being taught the basics of investing and money management through a series of gamified financial literacy workshops dubbed ‘Math and Money Challenge’.

The initiative is being undertaken by Natty Platforms Limited through funding from the United States Embassy in Kingston and aligns with the Government’s objective of achieving higher levels of financial inclusion and helping young people to develop wealth-building habits.

It targets students, aged 14 to 16, from Tivoli Gardens, Kingston; Commons off Read Hill Road in St. Andrew; and Gregory Park in Portmore, St. Catherine.

The gamified financial literacy workshops use virtual games and everyday experiences and situations to teach the youngsters the importance of saving and investing for the long-term.

Each participant will receive a $5,000 investment account funded by Dolla Financial Services Limited.

During the first session, held in Tivoli Gardens on February 18, the youngsters were engaged in sit-down sessions with financial literacy coaches and co-founders of Learn Grow Invest, Jermaine and Renate McDonald, before visiting the National Heroes Park to participate in maths and trivia challenges using Natty Platform’s Educatours App.

Fifteen-year-old student from Jamaica College, Latrell Jones, who attended the workshop held at the Tivoli Gardens community centre, told JIS News that the initiative provides an opportunity for young people in the community to be empowered.

“It (the workshop) is a great thing because it’s teaching the students of the community to manage their money well and not to spend it all and not have anything left,” he said.

Latrell expressed gratitude to the organisers for bringing the programme into the community, noting that youngsters will benefit greatly from the initiative.

Sixteen-year-old student from Kingston College, Matthew Jeffrey, who is also from Tivoli Gardens, said he appreciates being a part of the Maths and Money Challenge.

“The workshop is very interesting and it showed me that there are persons out there who are willing to come into the community and educate the members about finance. With them coming in to do this, it’s wonderful,” he told JIS News.

On his part, Jermaine McDonald said the students responded positively to the concepts being taught.

“We try to keep it very basic because we understand that investing is known to be complex and we didn’t want this session to be complex. We want it to be easily understood by somebody who has never heard about investing before,” he noted.

He encourages parents to consider teaching their children the principles of money management “as soon as they start to learn maths in school.”

Founder and Chief Executive Officer of Natty Platforms Limited, which is a gamification technology company, Kadeem Petgrave, said he wants to “help push purpose into underserved communities.”

“These youngsters are bright, they want to learn, they are inquisitive and they are enjoying themselves,” he told JIS News.

He noted that gamified financial literacy is a unique way to get young people, who often shy away from mathematics, interested in the subject.

“I know a lot of youngsters who are afraid of numbers and so we’re always brainstorming on ideas of how we can make learning fun for them,” he said.

Chief Operating Officer of the company, Simier Lansend, for his part, said parents should “pay attention to their child’s unique learning styles”.

“We, as adults, tend to think youth love their devices too much, but we don’t take the time out to really see why they love it. With this concept, we realise that they are more engaged and more interactive,” he said.

Other sponsors of the project include the Digicel Foundation and members of the communities.