DBJ Providing Low Interest Loans for Key Sectors

By: , September 26, 2014The Key Point:

The Facts

- The town hall meeting is part of a series organised by the Ministry of Finance and Planning in collaboration with the DBJ.

- Shelly-Ann Lewars from the Ministry’s Public Relations and Communications Unit, explained that the sessions are aimed at increasing the level of public awareness about Government’s Economic Reform Programme (ERP) and the availability of investment capital to SMEs and individual investors through the DBJ and DBJ-approved financial institutions.

The Full Story

Small and Medium-sized Enterprises (SMEs) in key sectors, are being encouraged to access low interest loans, provided by the Development Bank of Jamaica (DBJ), to finance their operations.

These loans are available for agriculture, agro-processing, renewable energy, and manufacturing.

The loan funding can be accessed through approved financial institutions (AFIs) such as commercial banks, credit unions, and the National People’s Cooperative Bank.

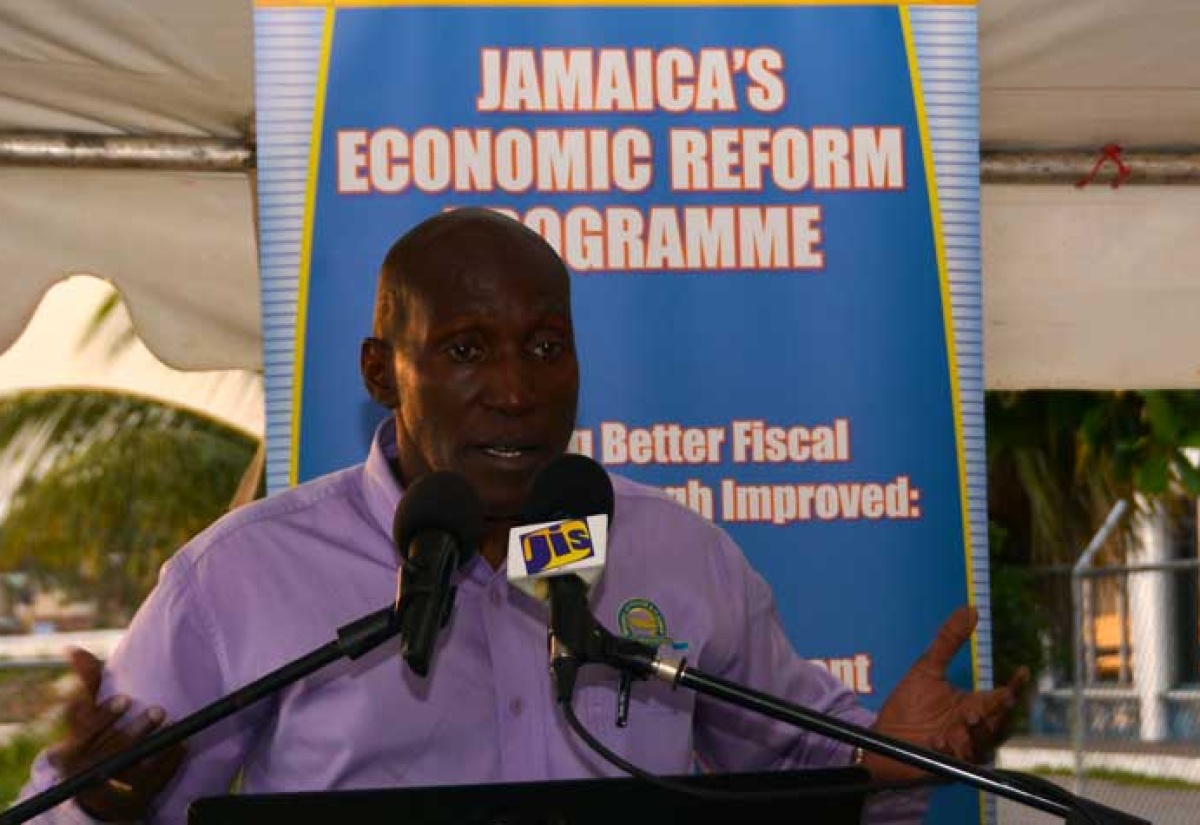

Addressing a Town Hall meeting at Black River Park on Wednesday September 23, 2014 Account Executive at the DBJ, Everton McFadden, informed that businesses in the targeted sectors can benefit from fixed interest rates for the life of the loans, at between 9.5 and 10 per cent per annum, for as much as $100 million.

He informed that other sectors, including mining, services and tourism, also qualify for low interest loans.

Mr. McFadden said the bank will also assist SMEs that are having difficulty with meeting collateral premium, with as much as 50 per cent of their amounts. He also gave the assurance of a five-work day turnaround processing time for applications.

The town hall meeting is part of a series organised by the Ministry of Finance and Planning in collaboration with the DBJ.

Shelly-Ann Lewars from the Ministry’s Public Relations and Communications Unit, explained that the sessions are aimed at increasing the level of public awareness about Government’s Economic Reform Programme (ERP) and the availability of investment capital to SMEs and individual investors through the DBJ and DBJ-approved financial institutions.