Shaw: Jamaica’s Economic Programme – Current Issues

August 7, 2011The Full Story

JAMAICA’S ECONOMIC PROGRAMME – CURRENT ISSUES

Address to the Nation

Hon. Minister of Finance

Good evening.

There have been conflicting reports about the status of Jamaica’s Standby Arrangement with the International Monetary Fund (IMF) on Jamaica’s Medium-Term Economic Programme. The IMF Agreement is the centerpiece around which the Medium Term Programme is built, and is a pre-condition for other multilateral support. Without it, Jamaica would not have had the necessary foreign reserves to have survived the deep dislocation caused by the worst economic crisis the world has known in 70 years — a crisis which caught us with a massive debt overhang, an anemic growth rate, and slim reserves to insulate us.

But the Medium-Term Programme is more than just an economic rescue programme that came at a period of crisis. The Medium-Term Economic Programme is the blueprint that points the way to the building of a credible foundation upon which our country can create a prosperous and sustainable economy.

So Jamaica’s Medium-Term Economic Programme is very important indeed. And it is for this reason that I am addressing you tonight.

For although I have shared various aspects of our progress with you – in both my speeches and my interviews….it is necessary for me to clear up some misconceptions, and to inform you of some important issues that face us at this juncture.

The last completed review with the IMF on Jamaica’s Economic Programme was in September 2010 when all the quantitative targets were met.

Contrary to speculation, the December 2010 and March 2011 quarterly assessments have not yet been reviewed by the IMF. That is, we have neither passed nor failed the reviews. It is a fact, however, that the overall assessment of our performance under the IMF Stand-By Arrangement (SBA) has been broadly positive, though there was slippage in the March 2011 quarter, particularly with respect to the Central Government primary surplus, which was $3.5 billion lower than programmed.

Why then, have the December and March Reviews not taken place?

The reviews have not taken place because the critical issue now facing the Government concerns our medium-term programme. That is, those targets which stretch beyond the life of the programme to 2015. Both ourselves and the IMF are focused on safeguarding the targeted measures necessary for us to achieve a sustainable fiscal path.

The medium-term target that is of primary concern is the public sector wages-to-GDP ratio. This is not to be confused with the recently concluded 7% wage settlement. Rather, this is a medium-term target for the period ahead, up to 2015.

At the end of the mast fiscal year (2010/11), the cost of central government wages was 10.7% of GDP. However this must be reduced to 9% of GDP by March 2016 under the Fiscal Responsibility legislation (including the FAA Act). This will require fresh negotiations with the public sector unions. These have already commenced and I am pleased to say, are progressing well.

In addition to the medium-term wage costs-to-GDP issue, other challenges have arisen since the presentation of the budget. They are:

The recent public sector wage settlement has added $10.4 billion to expenditure this fiscal year and $31 billion (just over 2% of GDP) over the medium term.

The planned divestment of the Government shares in Clarendon Alumina Production (CAP) has not yet materialized and this has led to higher than targeted expenditure; and,

For the first quarter of the 2011/12 fiscal year revenue and grants were $3.3 billion (4.2%) below budget

These factors have impacted negatively on our ability to meet the current year, as well as our medium term fiscal targets.

In the first instance, adjustments to the 2011/12 budget have to be made to achieve the targeted primary balance for this fiscal year. Accordingly, the first supplementary estimates are being prepared for Cabinet approval on August 15, 2011 and eventual tabling in Parliament at the end of August.

These adjustments involve cuts to capital and recurrent expenditure across Ministries, Departments and Agencies. This is because a sacrosanct part of our agreement is the commitment of expenditure on an “ability to pay” basis only. This is the only honest approach we can take towards achieving a sustainable future. It is folly to believe otherwise.

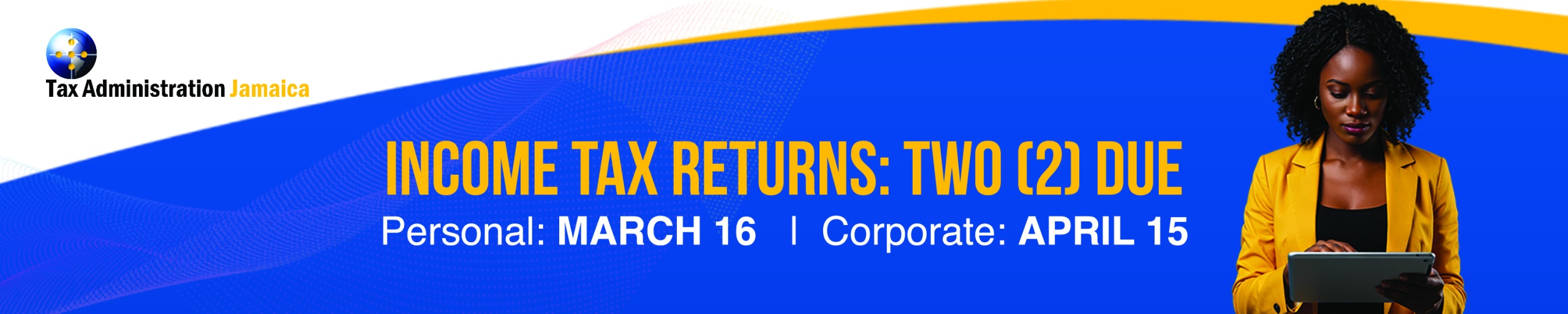

But expenditure is not the only side of the equation. The adjustments will also involve revenue enhancement measures. To this end, Tax Administration of Jamaica has launched the Revenue Enhancement and Arrears Project (REAP) aimed at collecting a significant portion of tax arrears.

As we make the necessary expenditure cuts and revenue enhancement efforts to achieve our primary balance target of 5% of GDP for this fiscal year, we are also now in discussions on how to return the medium-term programme to its original trajectory. This is of paramount importance as the IMF has indicated that their current concerns are:

The impact of the recent Public Sector 7% wage settlement on the medium-term

Tax reform including the regime governing tax waivers and incentives; and,

The delay in the divestment of Government’s shareholding in Clarendon Alumina Production (CAP)

Additionally, any deterioration in fiscal operations will compromise the achievement of the benchmarks in the debt indicators over the medium-term. This is also a concern as we remain committed to our fiscal consolidation path – also into the medium term.

We are therefore now in the process of initiating formal discussions on the Green Paper on Tax Reform over the next six weeks towards the tabling of a White Paper in Parliament in October.

Considerations of offers on the sale of our shareholdings in CAP should conclude by the end August when a decision will be made in the long-term interest of our Country.

Pension reform is on the way with the Green Paper finalized in September after which discussions will lead to the tabling of a White Paper in January 2012; and,

We have commenced dialogue with our public sector unions to define a predictable way forward for the determination of an appropriate formula for future wage settlements

Notwithstanding the challenges we now face, we must be proud of the positive gains achieved from our mutual sacrifice, which have come from fiscal restraint, the Jamaica Debt Exchange, and a new attitude of transparency in the management of the economic affairs of the country.

We must be encouraged by the fact that:

Our exchange rate is stable

Inflation is trending down

We have healthy foreign exchange reserves

We have the lowest interest rates in over a generation

We now have a return to positive economic growth over the past 2 quarters; and,

The creation of 15,500 net new jobs to the end of January

It is important to appreciate that, for the first time in a long time, all these positive indicators are occurring at the same time. In other words, lower interest rates were not achieved at the expense of the value of the Jamaican dollar or the rate of inflation.

In closing, may I assure you that the Government is putting out its best efforts to lock in the positive economic gains achieved thus far. This includes the establishment of sustainable fiscal operations and the creation of conditions for investment and growth.

We have worked diligently over the past 4 years with all our international development partners. This includes the achievement of an impressive score of 95 out of 100 performance objectives for not only the IMF programme, but 4 other multilateral programmes.

With God’s help, we are now confident that the necessary re-alignments will be done to further preserve and enhance investor confidence in this task of re-building the economy.

This could not have been done without your sacrifice and cooperation, and we must all steadfastly press ahead in the direction of our ultimate goal – the building of a more prosperous Jamaica.