MIDA to Expand Services

By: , May 31, 2016The Key Point:

The Facts

- The CEO pointed out that it is crucial for loans to be repaid by both the MFOs and the MSMEs in order for MIDA to retain its revolving fund.

- Other MFOs to which MIDA wholesale funds include Jamaica National (JN), Small Business Loan Limited, Access Financial Services Limited, and First Union Financial Company Limited.

The Full Story

The Micro Investment Development Agency (MIDA) is to rebrand itself in order to maximize its efforts of facilitating the development of the micro, small and medium enterprise (MSME) sector.

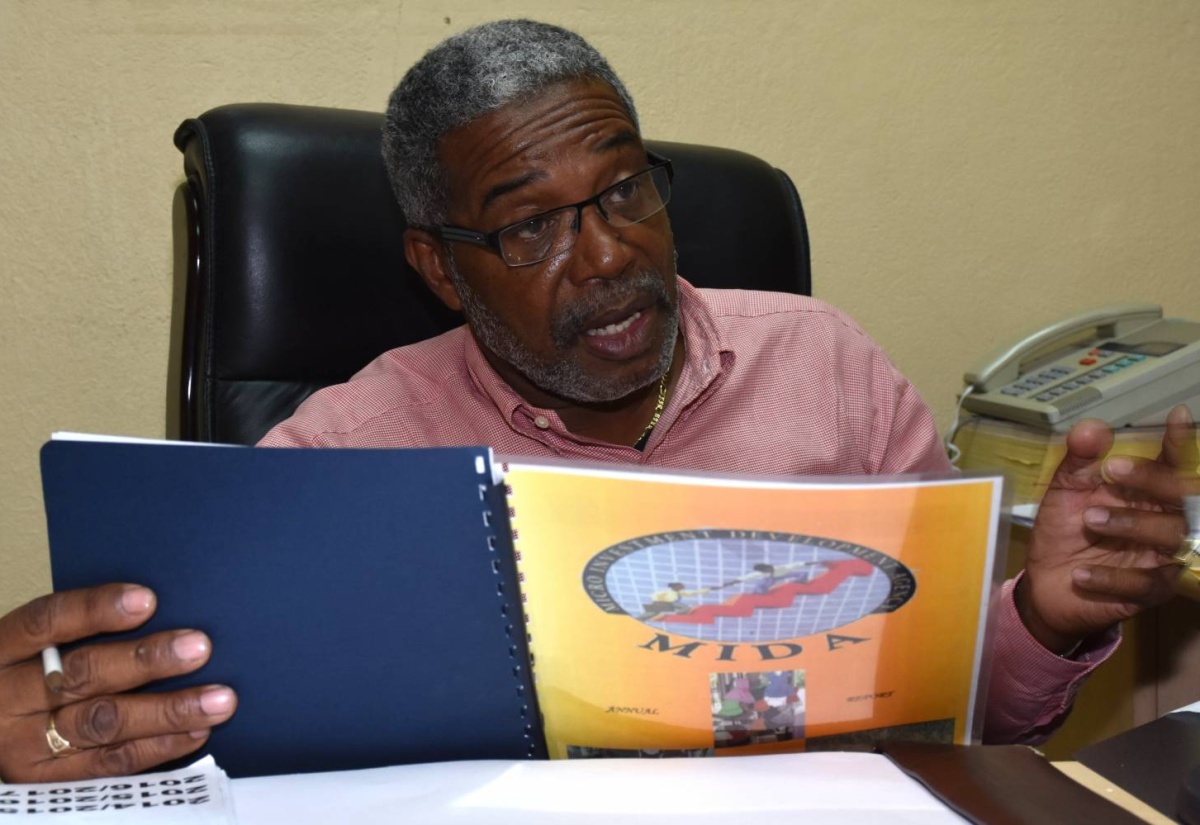

Speaking with JIS News, Chief Executive Officer (CEO) of MIDA, Lanville Henry, said the agency is to re-organize and focus on areas such as risk management, collections, debt management, including assessment of all bad debts and the analysis of credit before loans are granted.

MIDA’s current role is to provide funding to microfinance organisations (MFOs) for on-lending to new and existing MSMEs in agriculture, manufacturing and services, among other sectors.

Mr. Henry explained that the rebranding is part of efforts by the Government to implement an expansion strategy to widen the distribution capabilities through the MFOs, to ensure that credit is available, affordable and sustainable.

The CEO pointed out that it is crucial for loans to be repaid by both the MFOs and the MSMEs in order for MIDA to retain its revolving fund.

He noted that prior to the MFOs, MIDA financed the Community Development Funds (CDFs) which were the major retailers of the agency’s money, but eventually had to discontinue service due to challenges in administering and managing loans.

“We had to create a debt collection unit to get back these outstanding loans,” Mr. Henry said, adding that to date, the unit has successfully collected some $14 million from these defunct CDFs.

Mr. Henry pointed out that with the refocus and rebranding, MIDA will be engaged in similar debt collection activities with MFOs, such as the Self Start Fund and Jamaica Business Development Corporation, and any other government organization that has receivables outstanding.

Other MFOs to which MIDA wholesale funds include Jamaica National (JN), Small Business Loan Limited, Access Financial Services Limited, and First Union Financial Company Limited. This is done through a revolving pool of resources generated primarily from the Government of Jamaica/Government of the Netherlands Legacy Fund.