Work in Progress on Special Diaspora Bond

By: , March 14, 2018The Key Point:

The Facts

- Executive Director of the EGC, Senator Aubyn Hill, who notes that the concept is resonating across the diaspora, says work on the instrument entails studies to determine how the bond should and will be tailored; and putting together a prospectus to inform prospective bondholders on investment dividends.

- He indicated then that the EGC and, by extension, Government would benefit from the expertise of the Israeli Government’s Bond Director, Gideon Sitterman, whose services were sought by Mr. Lee-Chin during his visit to Jerusalem, where they had discussions.

The Full Story

Work is advancing on the development of a special diaspora bond, being spearheaded by the Economic Growth Council (EGC), which could possibly see it being floated on the market this year.

The bond will mainly target Jamaicans living in Canada, the United Kingdom and United States, and is part of the EGC’s initiatives to assist with the Government’s undertaking to lobby greater diaspora support for the country’s growth agenda.

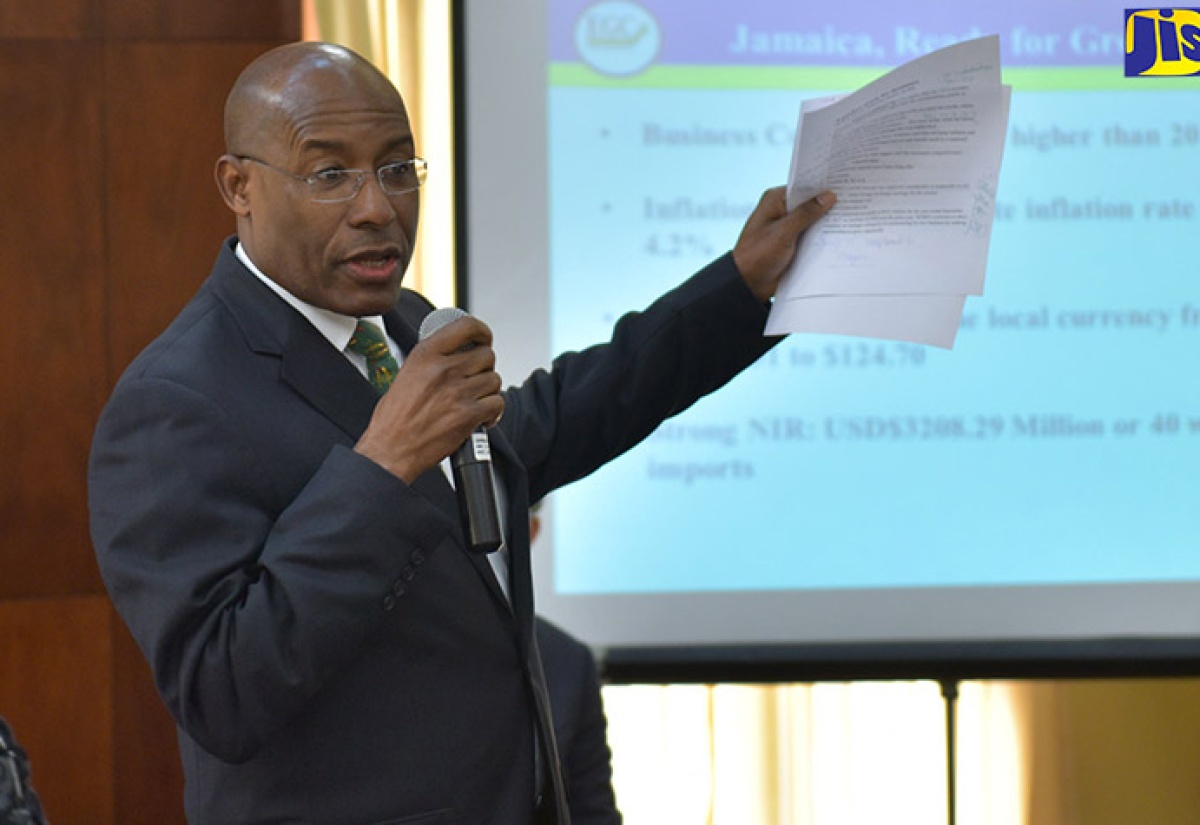

Executive Director of the EGC, Senator Aubyn Hill, who notes that the concept is resonating across the diaspora, says work on the instrument entails studies to determine how the bond should and will be tailored; and putting together a prospectus to inform prospective bondholders on investment dividends.

He tells JIS News that based on the extent of these engagements, “I would say that in about (four) months, we might be able to go to market,” subject to updates from and confirmation by the EGC’s Diaspora Working Group, which is chaired by Council member, Dr. David Panton.

Development and floating of the proposed bond was initially announced by EGC Chairman, Michael Lee-Chin, during the Council’s first quarterly report in January 2017.

He indicated then that the EGC and, by extension, Government would benefit from the expertise of the Israeli Government’s Bond Director, Gideon Sitterman, whose services were sought by Mr. Lee-Chin during his visit to Jerusalem, where they had discussions.

This collaboration was pursued against the background of Israel having what is widely regarded as the most successful diaspora financial services organisation globally, as also sharing similarities with Jamaica, in terms of diaspora community compositions.

As such, both gentlemen (Lee-Chin and Sitterman) explored how Mr. Sitterman’s expertise could be best leveraged to assist with Jamaica’s bond development, targeting Jamaicans residing in the United States, Canada and United Kingdom, as obtains for the Jewish State.

Mr. Sitterman said in addition to the EGC’s request, he was asked by the Israeli Prime Minister’s Office to assist, “based on mutual respect that both countries have for each other and the good relations that we have with Jamaica”.

Israel’s Government first floated bonds in 1950 during the tenure of the Jewish State’s first Prime Minister, David Ben-Gurion, in the aftermath of that country’s War of Independence, which devastated its economy and wiped out more than one per cent of the population.

The fledgling nation’s woes were further compounded by dire economic demands unique to the new State, consequent in part on the arrival of hundreds of thousands of immigrants from post-World War II Europe and the Middle East.

In light of this, Mr. Ben-Gurion convened a meeting of American Jewish leaders in Jerusalem in September 1950 where he proposed issuing bonds to help in providing Israel with a more secure economic foundation.

The proposal’s endorsement yielded US$52 million at the end of the first year of subscription in 1951, more than double the initial projections. Global sales of Israeli Bonds are estimated at approximately US$40 billion.

Mr. Sitterman noted that in addition to the economic benefits, the bond concept was intended to build a bridge between Jews in the Diaspora and those in Israel.

In this regard, he said development of the bond represents “an opportunity for the diaspora and Jamaica” to further strengthen their relationship, adding that “they will have the chance to come back and be part of the new approach to get growth”.

It is estimated that about 20 per cent of Jamaica’s income is comprised of remittances from families and friends overseas.