Property Tax Bills Passed by The Senate

By: , April 25, 2017The Key Point:

The Facts

- Opening the debate, Senator Johnson Smith said the Government has listened to the “real concerns” of the taxpaying citizens, and in particular those expressed by pensioners, farmers, small hotel owners, among others.

- “We have retained the flat $1,000 tax on all properties valued up to $400,000 which will redound to the benefit of 110,303 persons,” she said, adding that owners of small parcels of land found in communities such as Crawle River, Kellits, Mahoe Hill and Bull Head will benefit.

The Full Story

Two pieces of legislation giving legal authority to the Government to impose the new rates of property taxes, as well as validate the collection of property taxes from April 1, 2013, were approved by the Senate on April 21.

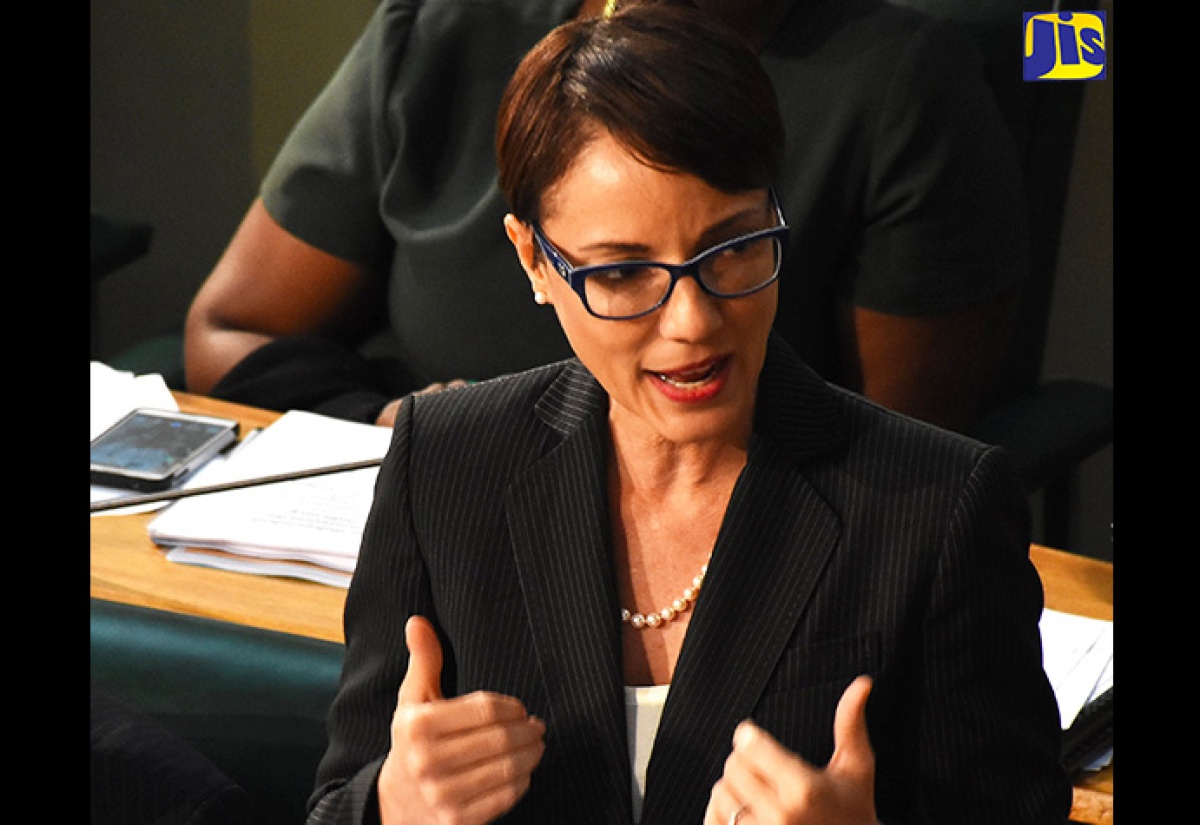

The Bills, the Property Tax (Amendment) No. 2 Act, 2017 and the Property Tax (Validation and Indemnification) Act, 2017, were piloted by Minister of Foreign Affairs and Foreign Trade and Leader of Government Business in the Senate, Hon. Kamina Johnson Smith.

They were passed without amendments.

The Government introduced a new property tax regime effective April 1, where property tax liabilities were based on the adoption of the 2013 valuation roll.

Opening the debate, Senator Johnson Smith said the Government has listened to the “real concerns” of the taxpaying citizens, and in particular those expressed by pensioners, farmers, small hotel owners, among others.

“We have retained the flat $1,000 tax on all properties valued up to $400,000 which will redound to the benefit of 110,303 persons,” she said, adding that owners of small parcels of land found in communities such as Crawle River, Kellits, Mahoe Hill and Bull Head will benefit.

She noted that the Government has introduced a tax regime with eight bands ranging from a low of 0.5 per cent to a high of 0.9 per cent, representing a significant reduction from the tax rates announced recently that ranged from 0.8 per cent to a high of 1.3 per cent of the land value.

The current rate structure is a far superior regime than the one that obtained under the previous Government where only three tax bands existed at rates of up to two per cent of land valued at more than $1 million.

Under the new regime, if the property is valued at $1.7 million, which falls within the 0.6 per cent tax band, the owner would still benefit from the flat $1,000 for the first $400,000, as also from the lower rates up to $1.5 million.

“He or she would really only pay 0.6 per cent on the values between $1.5 million and $1.7 million, so the owner would benefit from all the lower tax rates as well,” she explained.

The Minister said with this change in the tax rates, 448,360 or 58 per cent of the 776,487, properties will now see a reduction or no change in property tax bills.

She pointed out that this is a significant increase from the 35.1 per cent who would have benefited based on the previously announced rates for the 2017-18 period.

Senator Johnson Smith said with the new rates, the average increase in taxes for residential properties will now be 10 per cent compared with taxes last year, down from the 60 per cent average increase that was previously announced.

For commercial properties, the average increase will be 58 per cent compared with taxes last year, and down from the 137 per cent average increase that was previously announced. “This is real change,” she added.

In addition, for agricultural properties, the average increase is now 40 per cent compared with taxes last year, a significant drop from the 93 per cent average increase under the regime that was previously announced.

She said that 61 per cent of all property owners will see an increase of no more than 15 per cent, compared with their taxes last year.

The Minister added that despite the reduction in the rates, it is expected that some property owners will still see increases.

“So, 6,848 properties, representing 0.9 per cent of the total taxable properties with values over $20 million, will still see tax increases on average ranging from 201 per cent to 604 per cent. Most of these are commercial, which includes hotels, industrial, agricultural or subdivisions. Only 2,062 are residential properties,” she said

“Where properties are part of a business, such as a hotel or a farm, I think it is important for us to emphasise that relief is available for such property owners, including write-off of the property taxes against income taxes, and special relief of up to 50 per cent of the taxes for agricultural properties,” she added.

She noted that with a compliance rate of 57 per cent, the Government is expected to see a revenue yield of $6.5 billion, which is a shortfall of $2.1 billion.

This compares with the revenue of $8.6 billion the Government had expected based on the earlier announced rates.

Property tax payments provide for the collection of garbage, public sanitary conveniences, running water, road improvement works, street lighting, poor relief and community beautification.